Planned Giving

Legacy Gifts

Organization

Legal Name

Human Services Campus, Inc. DBA Keys to Change

Federal Tax ID (EIN)

46-3333160

Address

Keys to Change

ATTN: Development

204 S. 12th Avenue

Phoenix, AZ 85007

Contact

Christina Fankhauser

Director of Development

Keys to Change

(602) 689-1706

cfankhauser@keystochangeaz.org

Click here to request assistance with Planned Giving

Gifts for Now

Cash

Make an immediate impact with an outright cash donation, ensuring essential resources are available to those who need them most.

Donor Advised Fund

Recommend a grant from your Donor Advised Fund (DAF) at any time to help end someone’s homelessness today.

IRA Distribution

If you are 70½ years or older, you can make a tax-free gift of retirement assets (Qualified Charitable Distribution) directly from your IRA to Keys to Change. The gift may satisfy your annual required minimum distribution (RMD).

Stocks & Bonds

Real Estate

Gift or transfer a home, vacation property, farmland, or other real property to Keys to Change.

Insurance Policies

Donate a life insurance policy that has outlasted its original purpose or list Keys to Change as a beneficiary.

Business Interests

Vehicles

Donate an automobile, boat, classic car, motorcycle, or other vehicle with free towing from anywhere in the U.S. through our partnership with CARS (Charitable Adult Rides & Services).

Gifts for the Future

Bequest

Include a provision in your Will or Trust designating a specific dollar amount, a percentage of your estate, or other assets.

Beneficiary

Name Keys to Change as a beneficiary on your IRA, 401(k), 403(b), pension, or other tax-deferred retirement plan.

Charitable Trust

Create a Charitable Remainder Trust (CRT) to produce income throughout your lifetime or for a set term, and the remainder goes to Keys to Change at the end.

Planned Giving Testimonials

Steve Davis, Donor

“My career put me in a position to be able to help others. From my involvement at the Campus as a board member to fundraising and now volunteering, adding a provision to my trust for Keys to Change helps complete my philanthropic giving. It allows me to continue to help end homelessness and share my blessings long after I’m gone.”

Rima McIntire, Donor

“I want my legacy to reflect my deep belief in the power of community. In my estate planning, I’ve set up a fund that grows each year, and when I pass, the proceeds will go directly to Keys to Change. Supporting their mission to end homelessness is my way of standing with those who are struggling.”

Myron Hammes, Donor

“It’s simple – I believe homelessness is solvable. Including Keys to Change as a beneficiary of my life insurance policy was easy to do. It’s also a flexible option – I can call the insurance company to make changes whenever I need to. Solving homelessness takes hard work – supporting that work is simple with Keys to Change.”

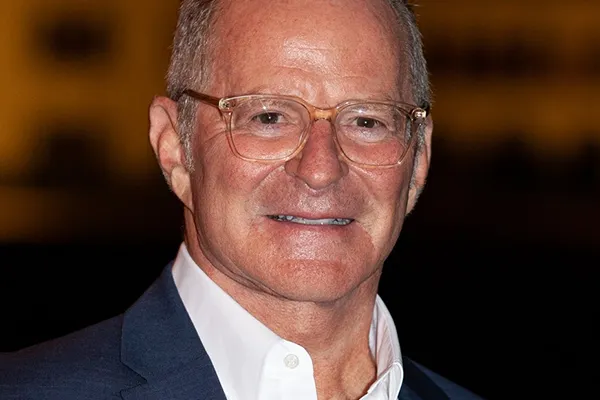

Jim Davis, Donor

“My advice? Don’t wait. I hadn’t prioritized estate planning until a near-death boating accident gave me a major wake-up call. Now I sleep well knowing that my family will be provided for once I’m gone, and that my passion for volunteering with the unhoused community will live on through my bequest to Keys to Change.”

Sample Bequest Language

Specific Bequest

Percentage Bequest

Residual Bequest

Contingent Bequest

Restricted Bequests

“If, in the judgment of the Board of Directors of Human Services Campus, Inc. DBA Keys to Change, it shall become impossible for Keys to Change to use this bequest to accomplish the specific purposes of this bequest, Keys to Change may use the income and principal of this gift for such purpose or purposes as the Board determines most closely align with my original intent.

Disclaimer: This information is not intended as legal, tax, or financial advice. For specific guidance, please consult an attorney or professional advisor.