Arizona Tax Credit

Because of donors like you, Juli and Peggy accessed vital services and ended their homelessness.

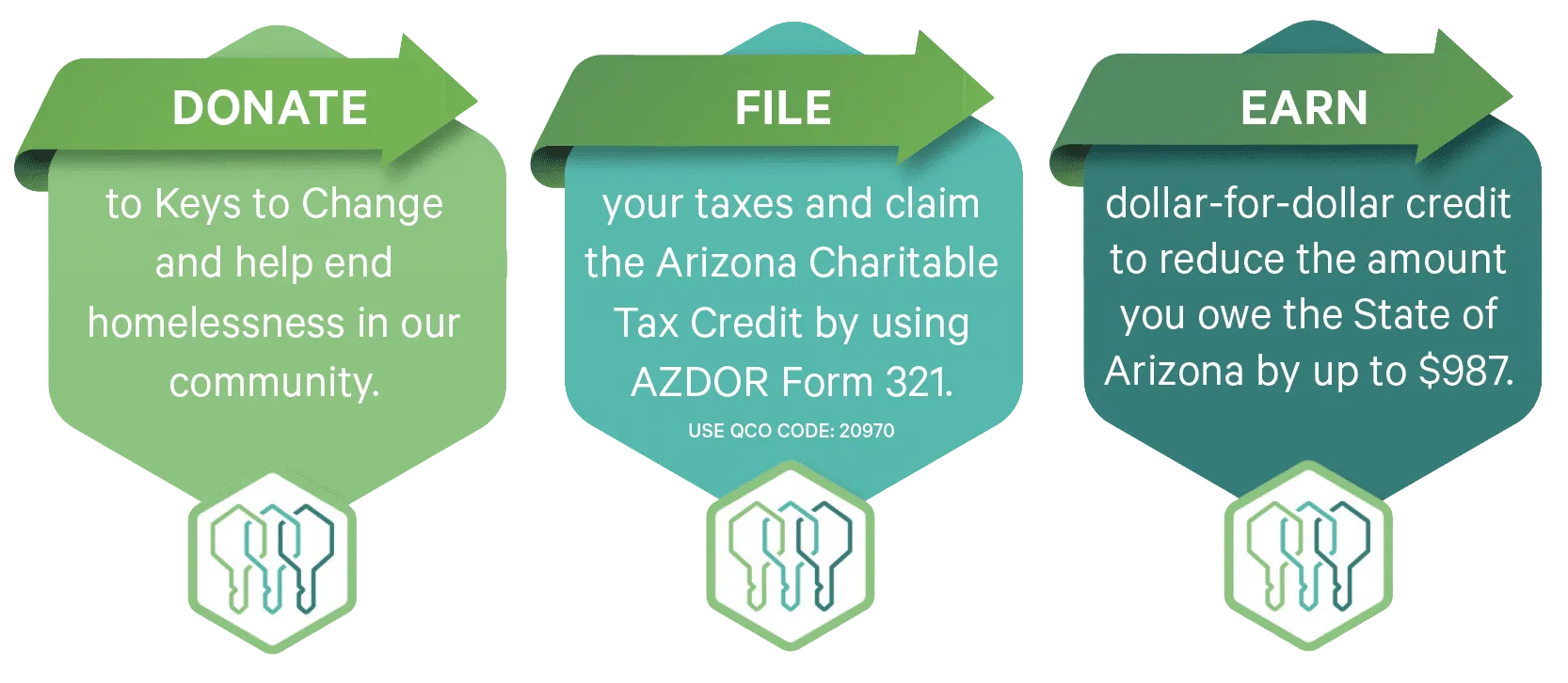

Donate now to help more people like Juli and Peggy achieve a fresh start. If you pay taxes to the State of Arizona, you could receive a dollar-for-dollar Tax Credit on your taxes – up to $987 per household. Please consult with your tax advisor.

Via Credit Card Online

Use the online form for simple, secure, and immediate payments. Give once, or set up a recurring donation with the click of a button.

Via Check

Send checks via U.S. Mail, payable to:

Human Services Campus, Inc.

204 S. 12th Avenue

Phoenix, AZ 85007

Attn: Finance Department

Arizona Charitable Tax Credit FAQs

Who is Keys to Change?

Keys to Change (Human Services Campus, Inc.) serves as the primary service organization for single adults experiencing homelessness in Maricopa County, offering a comprehensive range of programs that tackle the physical, behavioral, mental, financial, and/or legal barriers that hinder long-term success.

Keys to Change also leads Key Campus, a consortium of 13 nonprofit organizations working collaboratively to meet the needs of individuals working to end their homelessness.

What is the Arizona Charitable Tax Credit?

What does the Tax Credit mean for me?

When you donate to Keys to Change, you will receive a dollar-for-dollar tax credit on your Arizona state income tax return. This means that you can SUBTRACT the amount of your donation from the amount of taxes that you owe. It’s a great way to help people experiencing homelessness and help yourself at tax time!

Can I receive this credit if I already file for the school and/or foster care credits?

Yes. You can participate in all of the AZ tax credit programs, and receive a separate tax credit for each donation you make.

How much will I receive?

If you are a single taxpayer, you can receive a charitable tax credit up to $495. Couples filing jointly can receive up to $987 credit on their 2025 Arizona State income tax return. It is a direct dollar-for-dollar credit back to you.

What are my next steps?

Make your donation to Keys to Change by mail or online. List Keys to Change as your charitable organization along with your donation amount on AZ Form 321. Our QCO code is 20970. Every Arizona taxpayer who donates to Keys to Change qualifies for the credit. You do not need to itemize deductions to claim the tax credit.