GivingTuesday

Making a positive change.

This holiday season, give the gift of home with Keys to Change.

With your support, we’re ending homelessness in Maricopa County and providing dignity-restoring programs and services for our neighbors experiencing homelessness.

GivingTuesday is the perfect opportunity to make the most of your Arizona Charitable Tax Credit while supporting the work of Keys to Change.

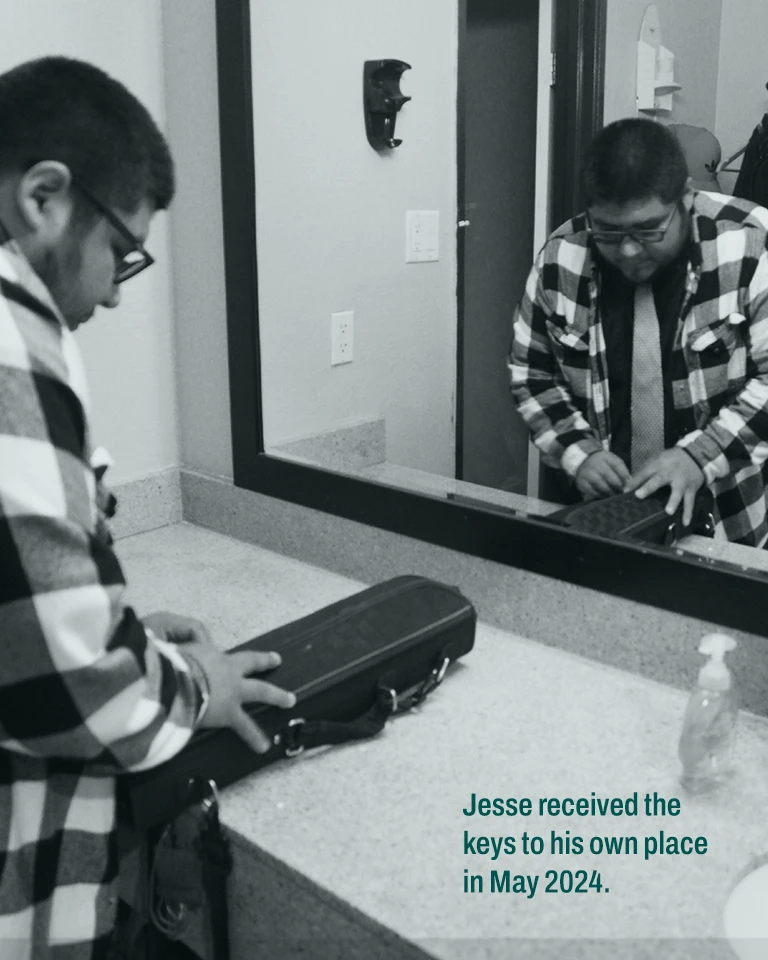

Jesse | A Word of Thanks (and a Song)

Arizona Charitable Tax Credit

Arizona Charitable Tax Credit FAQs

Keys to Change (Human Services Campus, Inc.) serves as the primary service organization for single adults experiencing homelessness in Maricopa County, offering a comprehensive range of programs that tackle the physical, behavioral, mental, financial, and/or legal barriers that hinder long-term success.

Keys to Change also leads Key Campus, a consortium of 15 nonprofit organizations working collaboratively to meet the needs of individuals working to end their homelessness.

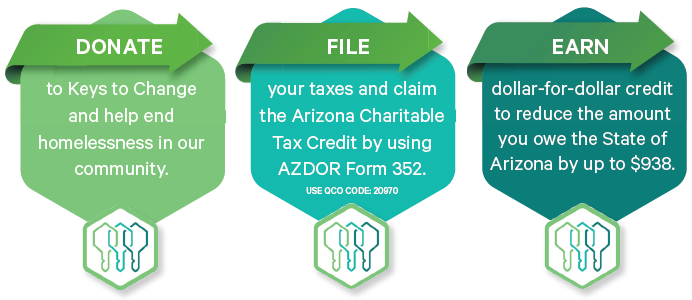

The Arizona Charitable Tax Credit is a tax credit for people who have made donations during the tax year to a Qualifying Charitable Organization (QCO) such as Keys to Change.

When you donate to Keys to Change, you will receive a dollar-for-dollar tax credit on your Arizona state income tax return. This means that you can SUBTRACT the amount of your donation from the amount of taxes that you owe. It’s a great way to help people experiencing homelessness and help yourself at tax time!

Yes. You can participate in all of the AZ tax credit programs, and receive a separate tax credit for each donation you make.

If you are a single taxpayer, you can receive a charitable tax credit up to $470. Couples filing jointly can receive up to $938 credit on their Arizona State income tax return. It is a direct dollar-for-dollar credit back to you.

Make your donation to Keys to Change by mail or online. List Keys to Change as your charitable organization along with your donation amount on AZ Form 321. Our QCO code is 20970. Every Arizona taxpayer who donates to Keys to Change qualifies for the Arizona Charitable Tax Credit. You do not need to itemize deductions to claim the tax credit.